rank real estate asset classes by risk

Different classes or types of investment assets such as fixed-income investments. Real estate experts and investors share different perceptions when it comes to ranking property and area classes.

Asset Classes Explained Understanding Investments Unisuper

Each asset class is unique regarding the related risk taxation ownership exchangeability revenue rules and market instability.

. What kind of building are you investing in. 300 Park Avenue 15th Floor New York NY 10022. Annuity perpetuity coupon rate covariance current yield par value yield to maturity.

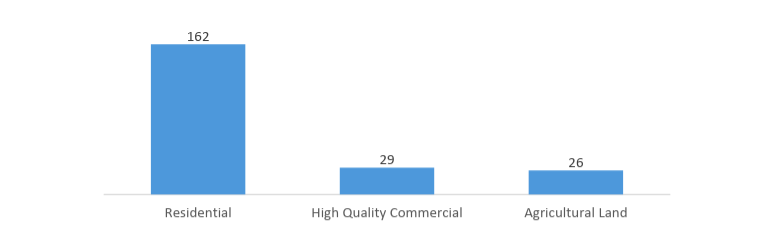

Within each asset class properties will be graded by quality ie. In commercial real estate this gets defined as. Within residential there are multifamily.

Needless to say economic shutdowns due to COVID-19 have had a devastating effect on commercial real estate. Peer-to-peer lending often called P2P lending means that you lend money to other people or companies directly without going through a bank. -Multifamily -Retail -Office -Student living -Light industrialsLogistics -Hotels -Co-working spaces I know that there are several factors playing into this but assuming as much is equal is possible what would be a plausible ranking.

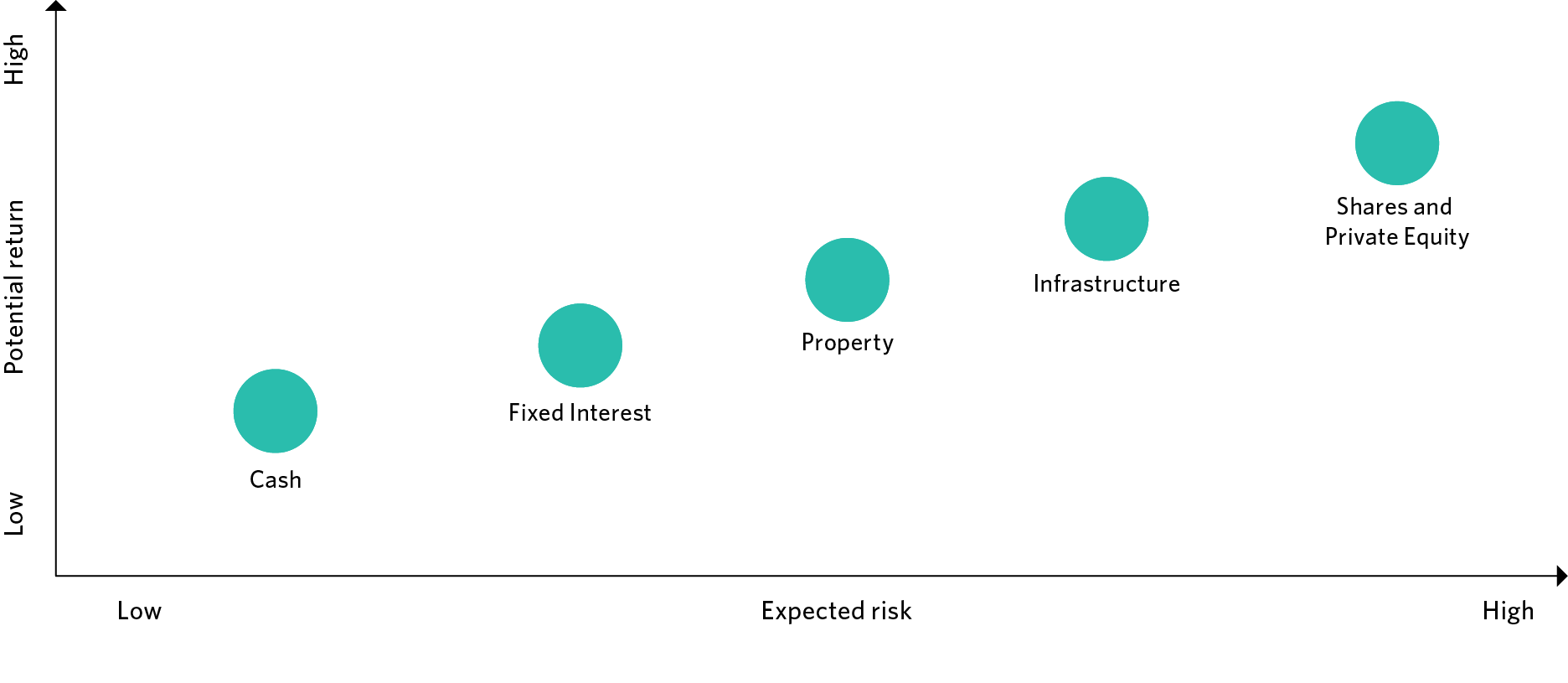

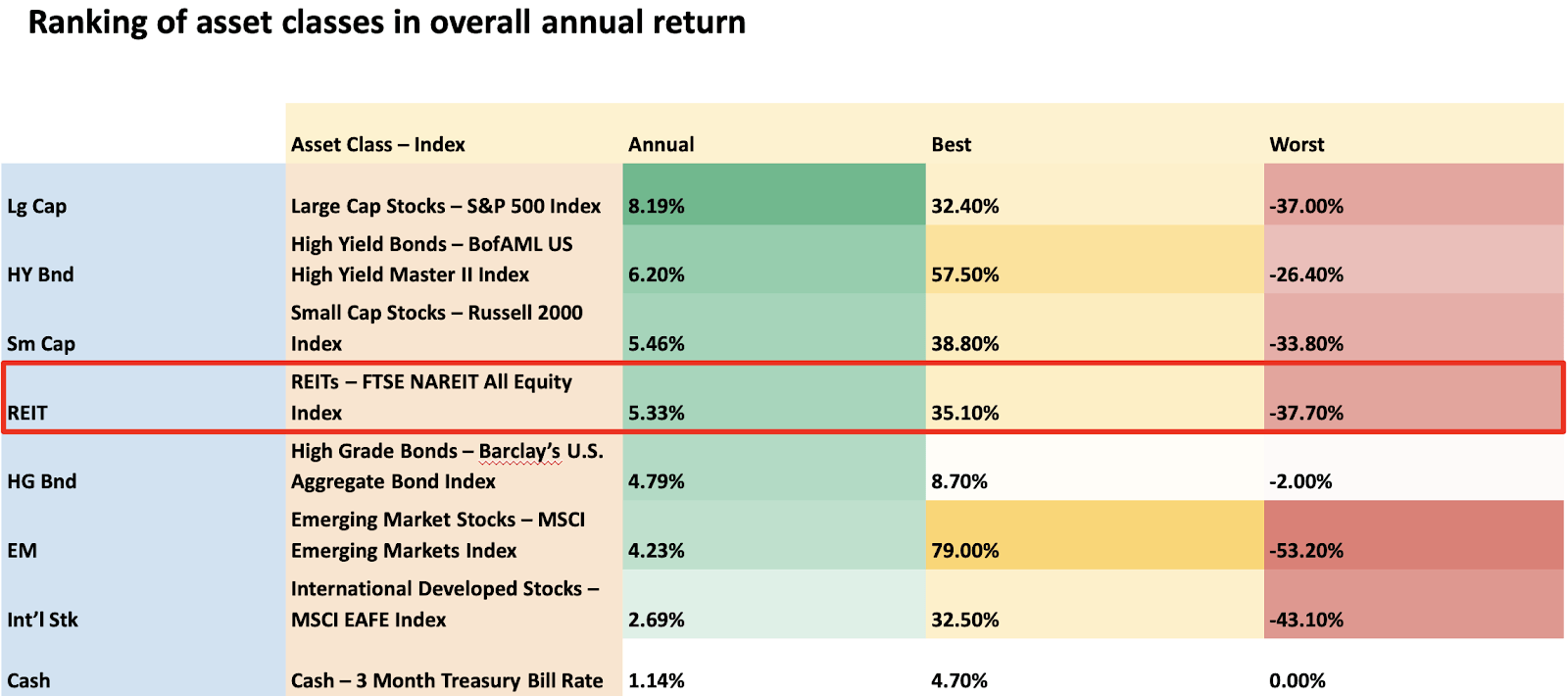

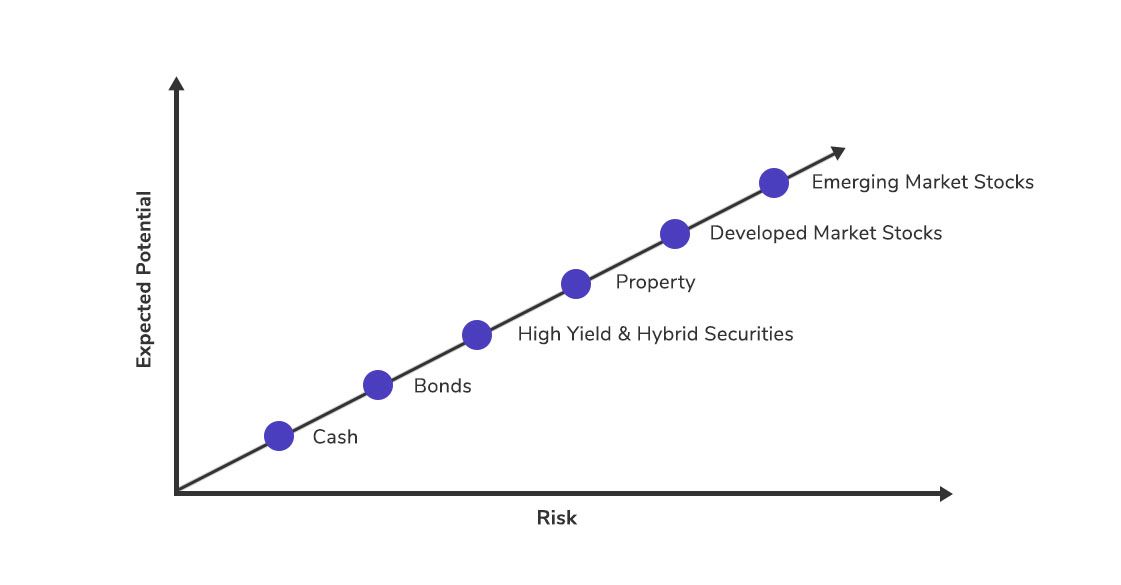

Backed by the US. Grading asset classes by risk and return cash is the most secure but least profitable asset class. The commercial real estate market is divided into six primary asset classes.

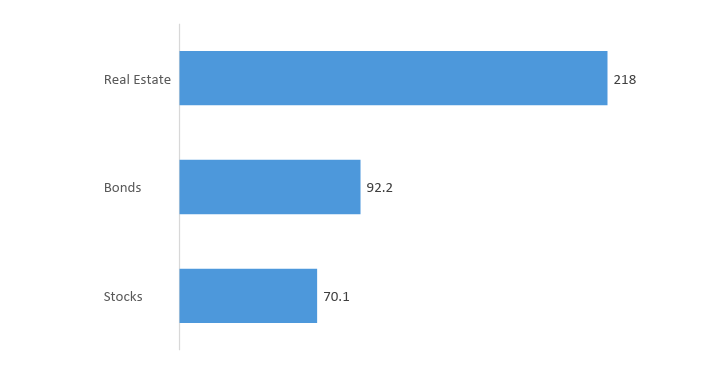

Properties that are fully or mostly leased with stable cash flow. Recessions tend to exacerbate these life events leading to increased rental activity in the self-storage space. Three traditional asset classes are equities or stocks cash equivalents or a Money Market and fixed income or bonds.

You alone assume the sole responsibility of evaluating the merits and risks associated with the use of this information before making any decisions based on such information. High risk with high return to low risk with low return. Real estate has the highest risk and the highest potential return.

Relatively low degree of leverage. Residential office industrial retail and hospitality. Including lower subcategories of each class such as A- B- and C- etc Category.

As bank charges are omitted from the process investors. Risk and return drivers for real estate include. Class A B C etc driven largely by age and upkeep as well as sub-divided by business plan eg.

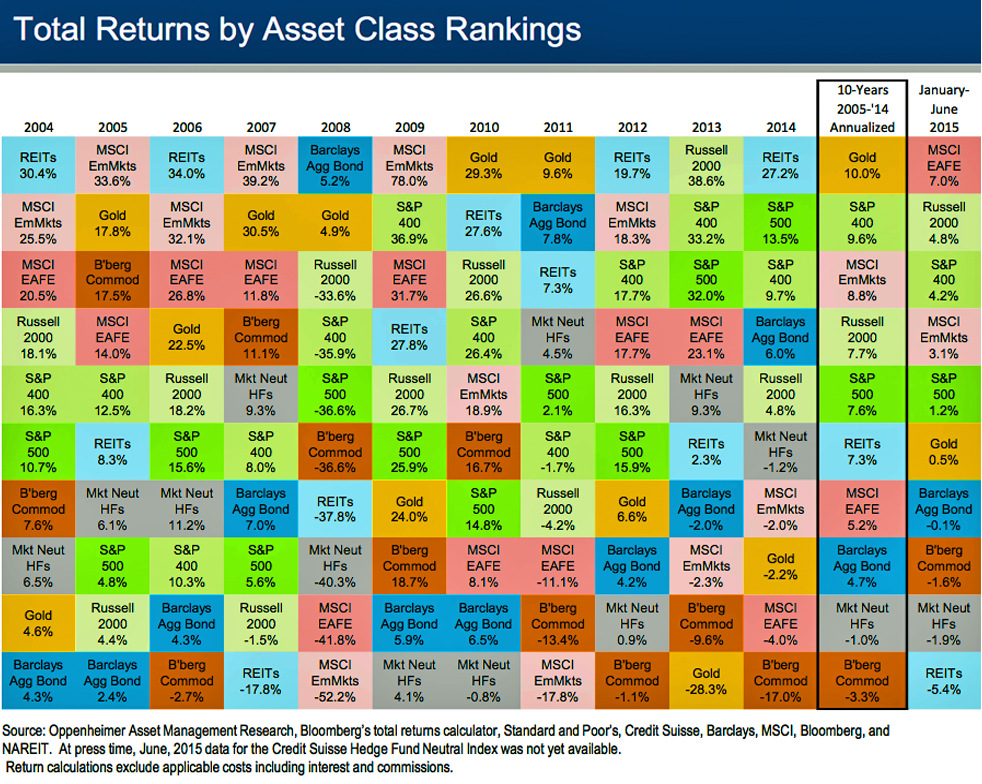

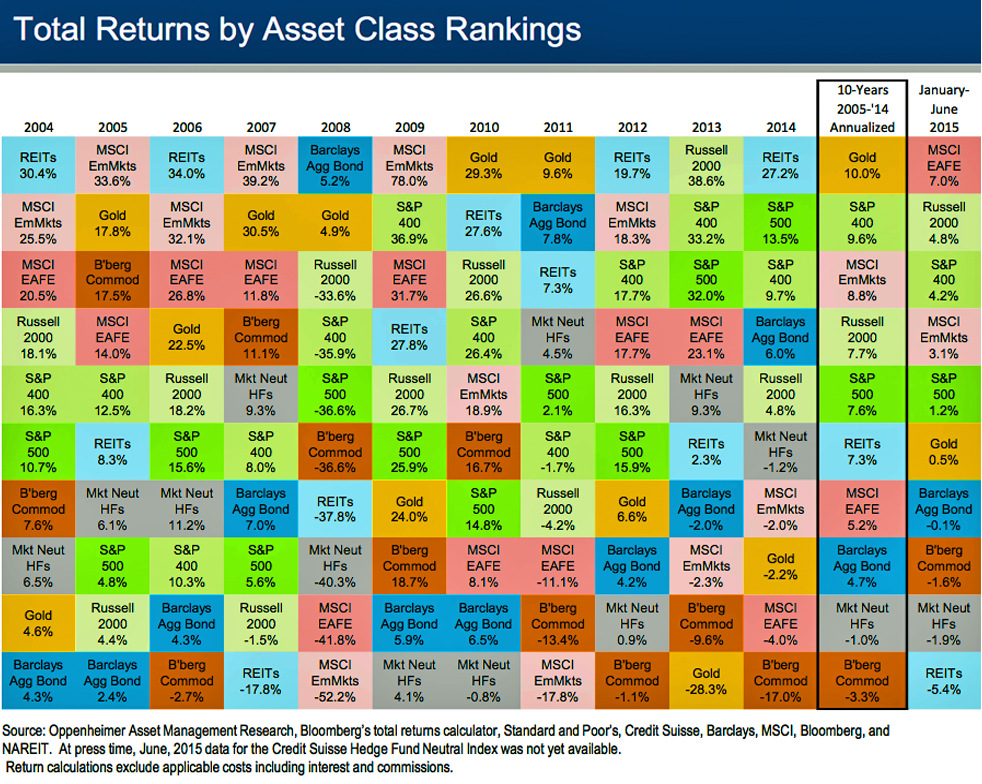

The top-performing asset class so far in 2020 is gold with a return more than four times that of second-place US. Commercial real estate offers two ways to diversify your investment portfolio. In commercial real estate this gets defined as Class A B C or D.

In fact self-storage REITs were the only real estate asset type that was. Global commodities saw the lowest return over the last 10 years. Im mainly looking at.

Risks and rewards of ownership Interest rates Rents Capital gain or loss on sale of direct holdings The role of. Im mainly looking at. Why Equities Are the.

The Preferred section is comprised of the 10. Most will rank them on a general scale from Class A to Class C with others going as far as from Class A to Class F. The ABCs Of Real Estate Asset Classes.

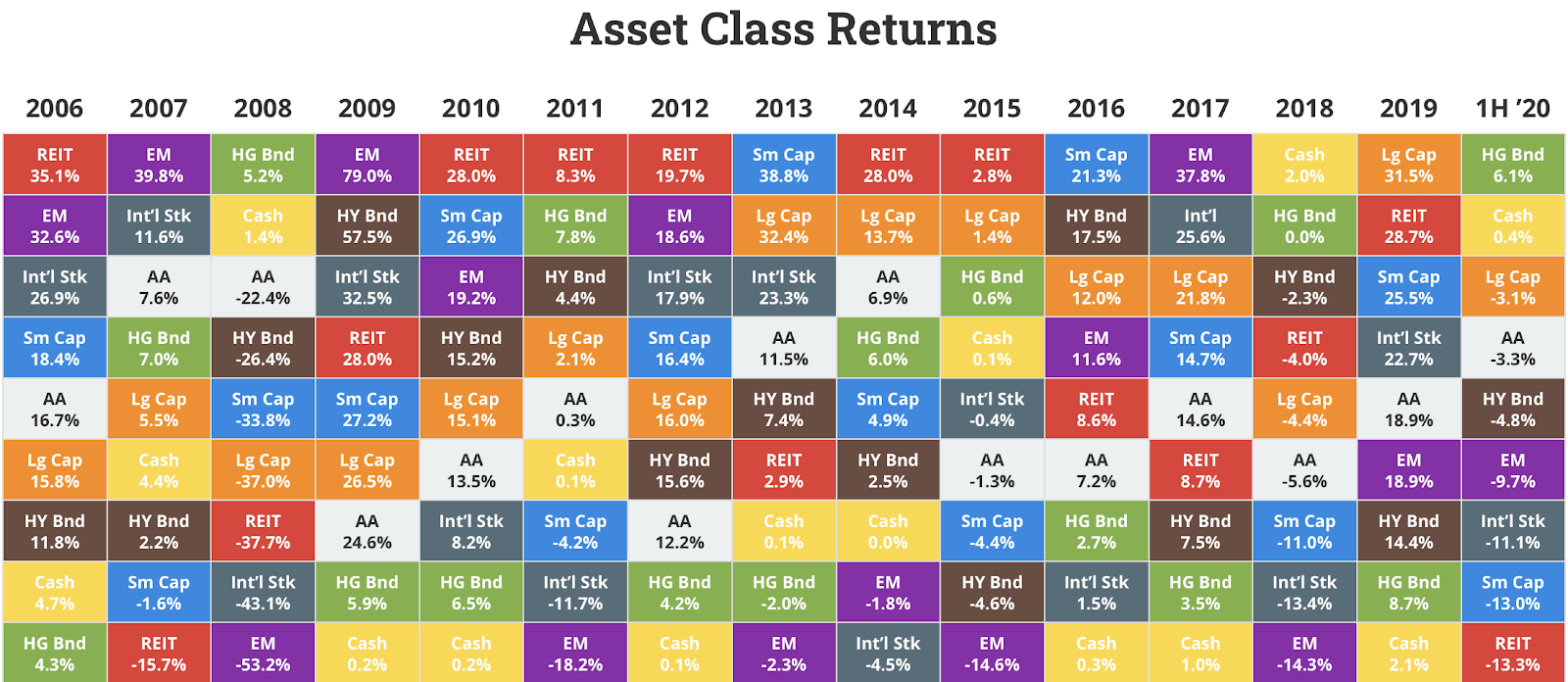

An asset class is a group of similar investment vehicles. While there have been many opinions forecasts and viewpoints about how different real estate asset classes will perform coming out of the pandemic sometimes its best to see where the money has already been flowing. 1 These include Robert Shiller stock and real estate data Aswath Damodaran bond and cash data and Portfolio Visualizer asset class data.

On the other hand real estate investment trusts REITs have been the worst-performing investments. Within private equity real estate assets are typically grouped into four primary strategy categories based on investment strategy and perceived risk. 13 Last Rank of Time In Top Half of Ranks Ranks 1-6 Emerging Market Stocks.

Asset classes in real estate are better understood if you think of them as alternative assets that fall into a. The first asset class is real estate. Reonomy conducted an insightful report on where and how 35 of the largest institutional investors are allocating their funds.

2 Because this table comes from a list of just 10 assets going back to 1972 the standard deviations of ranks are necessarily lower and arent directly comparable to the standard deviations in the. Class Real estate experts and investors share different perceptions when it comes to ranking property and area classes. Lastly there is real estate.

The four Ds downsizing divorce dislocation and death- are aspects of real life. Assets classified as real estate include a persons residence rental or investment properties as well as commercial real estate holdings. What is an Asset Class.

Ranking the real estate asset classes in terms of risk Dear all. See the bottom of the graphic for the specific indexes used. Fixed Income Bond Terms Definitions for the most common bond and fixed income terms.

The Class A. The property is in good shape with little need for major renovations. Additionally two common alternative asset classes are commodities and as you may have guessed real estate.

Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk. Most will rank them on a general scale from Class A to Class C with others going as far as from Class A to Class F. Asset classes risk and return.

One example would be Real Estate Investment Trusts REITs. Including lower subcategories of each class. Those four categories are core core-plus value-added and opportunistic.

As companies and consumers downsize storage will continue to see demand. Standard Deviation of Ranks. -Multifamily -Retail -Office -Student living -Light industrialsLogistics -Hotels -Co-working spaces I know that there are several factors playing into this but assuming as much is equal is possible what would be a plausible ranking.

Federal government Treasury coupons. Standard Deviation of Ranks. When investing some assets are considered safe while others are considered risky this includes savings accounts T-bills certificates of deposit equities and derivatives.

The key differentiator between these categories is the risk and return profile. Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk. This strategy corresponds to the low-return-low-risk end of the spectrum and typically exhibits the following characteristics.

Plummeting oil prices and an equities bull market that left little demand for safe haven assets like precious metals likely contributed to the asset class underperformance.

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Future Of Alternatives 2025 Aum Growth Of 3 4 A Year Will Not Lift All Real Estate Segments

Towercrest Capital Management Wealth Management Business Risk Wealth

Commercial Real Estate Trends Toptal

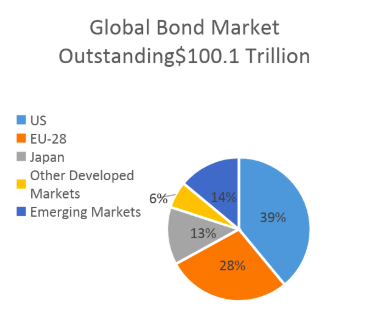

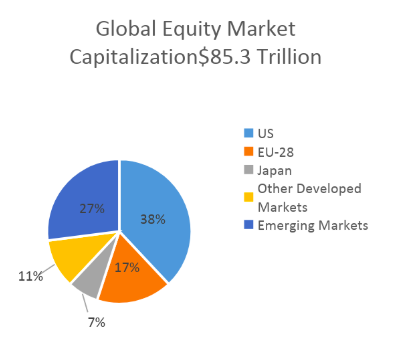

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

Asset Class Definition Types Of Asset Classes Franklin Templeton

Meyer Asset Management Ltd Tokyo Types Of Investment Funds Investing Finance Investing Asset Management

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Chart The Historical Returns By Asset Class Over The Last Decade

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

Annualized Returns By Asset Class From 1999 To 2018 Financial Samurai Investing Real Estate Best Investments

Annual Asset Performance Comparison 1972 2021 Bullionvault

Know Your Real Estate Risk Reward Spectrum Before Investing

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

Future Of Alternatives 2025 Private Debt S Spectacular Rise Will Continue